sandq.ru

News

Does Robinhood Have Iras

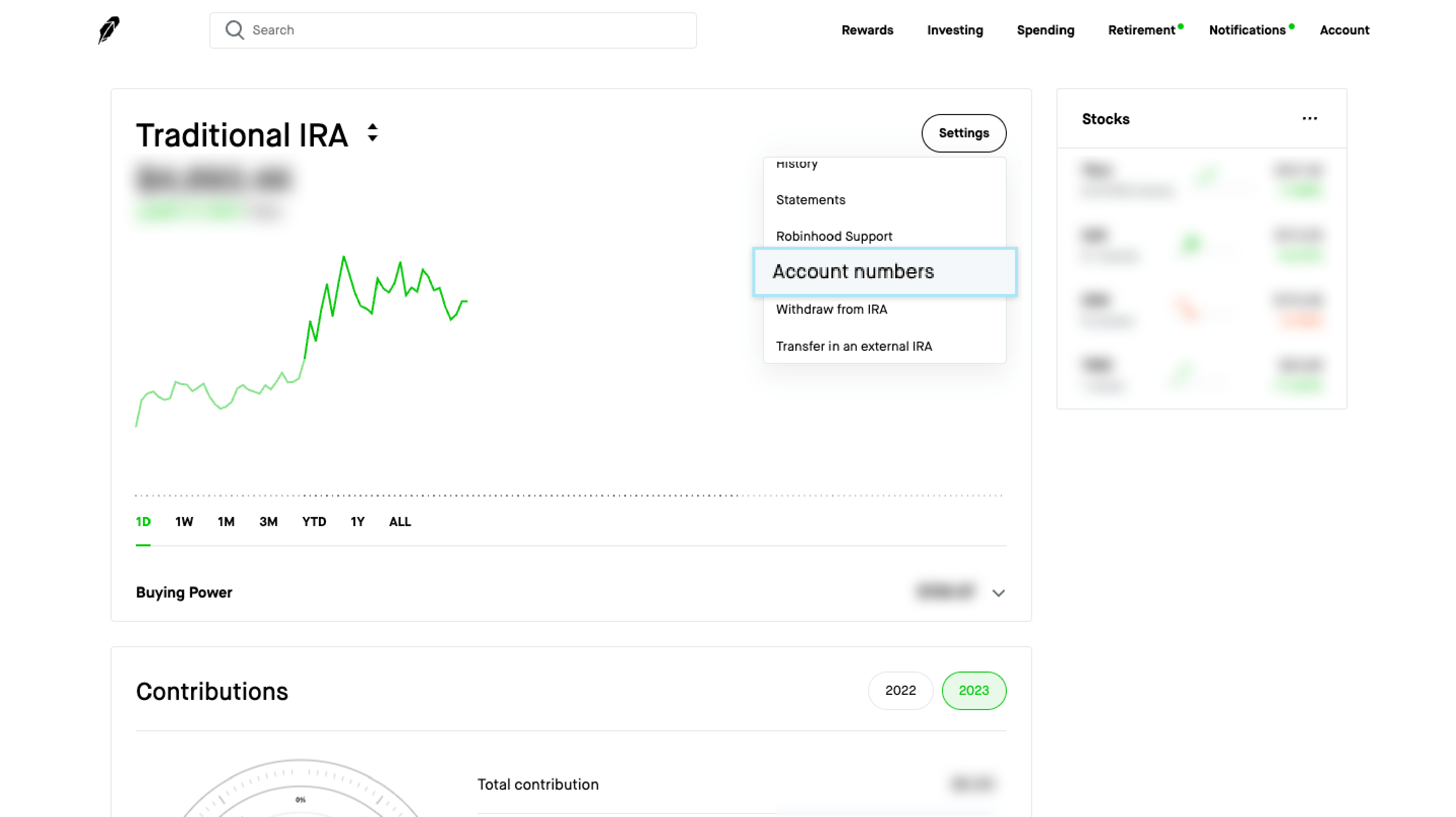

Then, during retirement, your qualified withdrawals are taxed like ordinary income. Ready to start investing? Sign up for Robinhood and get stock on us. How many Robinhood accounts can I have? Robinhood now supports multiple accounts per customer, including individual brokerage accounts and IRAs. Can I keep the. The IRA match is an extra 3% match on annual contributions with Robinhood Gold or 1% without. Previously, you got matched on every external dollar you. Robinhood Retirement reimagined not just what an IRA could be, but how it could look and feel. Taking the bold first step toward investing in your future. Get the biggest instant IRA contribution match with Robinhood Gold. Earn 3% extra on every annual contribution to your IRA when you subscribe to Robinhood Gold. How do I enable options in Robinhood Retirement? Was this article helpful? Reference No. Still have questions? You can (as I have) use Boglehead principles and strategies in Robinhood. They have ETFs. They have IRAs. They have zero trading fees. Make sure you're eligible to convert a traditional IRA to a Roth IRA before submitting your request. Robinhood is required by law to report a Roth conversion. What is a Roth IRA? Robinhood Learn. Democratize Finance For All. Our writers'. Then, during retirement, your qualified withdrawals are taxed like ordinary income. Ready to start investing? Sign up for Robinhood and get stock on us. How many Robinhood accounts can I have? Robinhood now supports multiple accounts per customer, including individual brokerage accounts and IRAs. Can I keep the. The IRA match is an extra 3% match on annual contributions with Robinhood Gold or 1% without. Previously, you got matched on every external dollar you. Robinhood Retirement reimagined not just what an IRA could be, but how it could look and feel. Taking the bold first step toward investing in your future. Get the biggest instant IRA contribution match with Robinhood Gold. Earn 3% extra on every annual contribution to your IRA when you subscribe to Robinhood Gold. How do I enable options in Robinhood Retirement? Was this article helpful? Reference No. Still have questions? You can (as I have) use Boglehead principles and strategies in Robinhood. They have ETFs. They have IRAs. They have zero trading fees. Make sure you're eligible to convert a traditional IRA to a Roth IRA before submitting your request. Robinhood is required by law to report a Roth conversion. What is a Roth IRA? Robinhood Learn. Democratize Finance For All. Our writers'.

Can I get another retirement recommendation? At this time, you can only invest in one retirement recommendation per IRA you have with Robinhood. · How do I. Yes! With a Robinhood IRA, it's simple to set up automatic—or recurring—contributions. You can choose a schedule that works for you: Weekly, for a contribution. Does it make sense to have a Roth and traditional IRA? Yes, it Is there a Robinhood-type app for retirement accounts (e.g. k, IRA)?. The Robinhood IRA is available to any of our US customers with a Robinhood brokerage account in good standing. Note, if you have a B-Notice, you won't be able. The Robinhood IRA is available to any of our US customers with a Robinhood investing account in good standing. Note, if you have a B-Notice, you won't be able. The IRA match is an extra 3% match on annual contributions with Robinhood Gold or 1% without. Previously, you got matched on every external dollar you. Life insurance calculator How much do you need? Life insurance resources Robinhood · Merrill Edge · Vanguard · Fidelity · SAVINGS AND CD RATES · CD Rates. If you have a traditional IRA with Robinhood with an RMD amount of $1,, and a traditional IRA at ABC company with an RMD amount of $, you could choose to. Does it make sense to have a Roth and traditional IRA? Yes, it Is there a Robinhood-type app for retirement accounts (e.g. k, IRA)?. It's not you Robinhood, it's me. Well, actually, it's mostly you. I have two investment accounts. One is a ROTH IRA through Charles Schwab. I recommend getting Robinhood Gold, contributing as much as you can to your Roth IRA, and investing all your money in a fund called VT. There. Although Robinhood doesn't charge any management fees on this account, there may be an early IRA removal fee for withdrawing money from your account after fewer. Last year, investing platform Robinhood launched Robinhood Retirement—an IRA product that lets users save for retirement in a traditional or Roth IRA with. IRA overview IRA contributions IRA contribution adjustments IRA withdrawals Transfers and rollovers Robinhood IRA Transfers Gold Match Retirement investing IRA. How do I enable options in Robinhood Retirement? Was this article helpful? Reference No. Still have questions? Robinhood allows you to choose your rollover method in the app. IRA owners can elect to partner with Capitalize, at no additional cost, to help find and connect. The qualified charitable distribution or QCD (also known as an “IRA charitable rollover”) is a great way to make a tax-free gift now to Robin Hood and satisfy. Robinhood IRA account holders can choose from a broad range of investment options, ranging from stocks and ETFs to cryptocurrency, fractional shares, and. You can open one of each kind of IRA that Robinhood offers even if you have other retirement accounts elsewhere, though you'll still have to abide by the. Robinhood Gold is a suite of powerful tools, data, and features designed to take your investing to the next level. With Gold, you get the following premium.

Buy Gold Bars Canada

Buy gold bullion in Canada online from your home or a TD branch. You can trust TD Precious Metals to deliver high quality gold bullion products. Choose the best on Gold Bullion at Colonial Acres Coins, the best numismatic online shop in Canada. Buy our collection of Gold Bars in canada! Get the best gold price in Canada. This is a great and affordable way to invest in Gold Bullion! Canadian Bullion Services offers Gold and Silver Coins, Rounds, Wafers and Bars including Silver Maple Leaf and Gold Maple Leaf coins. Buy this 1 Kilo (RCM) Royal Canadian Mint Gold Bar from ITM Trading™ of % FINE GOLD minted by Royal Canadian Mint in Canada. This Gold Bar Is IRA. pure gold content in its Canadian Gold Maple Leaf coins. Each Canadian Gold Maple Leaf coin is available in 1 oz, ½ oz, ¼ oz, 1/10 oz, 1/20 oz, and now 1. Gold Bars for Sale in Canada ; 1 kg Pure Assorted Gold Bar. CA$, ; 10 oz Pure Assorted Gold Bar. CA$34, ; 1 oz Royal Canadian Mint Gold Wafer Bar. Some of our most popular gold coins include: Canadian Gold Maple Leaf: The Royal Canadian Mint's 1 oz Canadian Gold Maple Leaf (Random Date) coins are among the. Looking to Buy Gold Coins & Gold Bars? Shop 1 oz, 1/10 oz, 1 kg Gold Bullion with Sprott Money Canada. Price Match. Buy gold bullion in Canada online from your home or a TD branch. You can trust TD Precious Metals to deliver high quality gold bullion products. Choose the best on Gold Bullion at Colonial Acres Coins, the best numismatic online shop in Canada. Buy our collection of Gold Bars in canada! Get the best gold price in Canada. This is a great and affordable way to invest in Gold Bullion! Canadian Bullion Services offers Gold and Silver Coins, Rounds, Wafers and Bars including Silver Maple Leaf and Gold Maple Leaf coins. Buy this 1 Kilo (RCM) Royal Canadian Mint Gold Bar from ITM Trading™ of % FINE GOLD minted by Royal Canadian Mint in Canada. This Gold Bar Is IRA. pure gold content in its Canadian Gold Maple Leaf coins. Each Canadian Gold Maple Leaf coin is available in 1 oz, ½ oz, ¼ oz, 1/10 oz, 1/20 oz, and now 1. Gold Bars for Sale in Canada ; 1 kg Pure Assorted Gold Bar. CA$, ; 10 oz Pure Assorted Gold Bar. CA$34, ; 1 oz Royal Canadian Mint Gold Wafer Bar. Some of our most popular gold coins include: Canadian Gold Maple Leaf: The Royal Canadian Mint's 1 oz Canadian Gold Maple Leaf (Random Date) coins are among the. Looking to Buy Gold Coins & Gold Bars? Shop 1 oz, 1/10 oz, 1 kg Gold Bullion with Sprott Money Canada. Price Match.

Invest in your financial future with TRB Bullion. Buy Gold Bars and Coins in Canada at the best prices. Check out our prices today and start investing Now! Bars and Wafers · 1 oz. (10 x 1/10 oz.) · Silver Bar (Bullion) · 1 oz. % Pure Gold Wafer (Bullion) · 1 oz. % Pure Gold Wafer (Bullion). Bullion Mart is the trusted precious metal dealer in Canada, exclusively silver and gold. We give you focused, up-to-minute pricing and we ensure your precious. The 1 oz Royal Canadian Mint Gold Bar contains 1 oz of pure gold content with purity. Produced by the famed Royal Canadian Mint and available in varying. Buy and sell gold bars and gold bullion bars in Canada at most competitive prices. The best gold bars and bullion bars dealer in Toronto, Canada. 1 oz Royal Canadian Mint Gold Bar (New In Assay) kt yellow gold 1 troy oz ( g) Item cannot be returned or refunded This item is not eligible for. Buy gold bars right here in Canada on the Royal Bull Silver & Gold website. Each gold bar on this shopping page comes to you encased in a protective assay. Purity: The Royal Canadian Mint's gold bars are typically made from fine gold, which means they contain % pure gold. This high level of purity is one. This 24 karat 1oz Gold RCM Bar is the perfect investment piece for those looking to secure their futures with a Precious Metals IRA. Buy gold bars and bullion online in Canada from sandq.ru We have gold bars for sale at live prices. Gold Stock is a precious. We are pleased to bring you the best gold coins and bars from Canada and from abroad. We put the world of bullion at your fingertips. Buying gold bars online is easy as there is no hidden price. We have gold bars of different makes for sale. Check live prices and then decide. In Canada, gold bullion is considered an investment vehicle and is exempt of tax. For a gold bullion piece to be considered investment grade, it must have a. We also offer gold coins from mints around the world like the Canadian Maple Leaf, the Australian Gold Kangaroo, and the South African Gold Krugerrand. Specific. Silver Gold Bull Canada is Canadas leading bullion dealer. We deliver gold coins, gold bars, silver coins, silver bars and precious metals to your door. 1 oz Gold Bar – Johnson Matthey (Trojan Horse) SKU: BU · gram Republic Metals (RMC) Gold Bar (w/Assay) · Save $40 · 1 oz Royal Canadian. The Royal Canadian Mint ensures the purity of your purchase, and the Government of Canada ensures the weight and fineness of Canadian Mint gold bars. Credit. Buy online from Canadian Precious Metals Exchange. We're Toronto's trusted gold and silver dealer with % secure shopping. Buy Gold Bullion Canada · Our margins are up to 50% lower than major competitors · 13 store-front locations across the country, offering same-day, local. sandq.ru (sandq.ru) sells online. You may want to save up another cad to buy 1 oz of.

Can You Buy Shiba Inu On Robinhood

Robinhood has recently extended the · Shiba Inu trading services to the 7th-largest state in the United States – the state of Nevada. This marks a significant. This right here is a clear giveaway & a big indication of a Robinhood listing which according to Vinod Dsouza (), Robinhood could list Shiba. The price of Shiba Inu is € Buy Shiba Inu - SHIB with €1. Invest in SHIB cryptocurrency with Robinhood in the easiest and fastest way. Breaking: Shiba Inu Is Now Listed on Robinhood. Should You Buy? April 12, — pm EDT. Written by Motley Fool Staff for The Motley Fool ->. If you have a margin account (through Robinhood Financial) and are using margin buying power, you can't place a crypto order in your Robinhood Crypto account. Robinhood users can also buy and sell stocks, options, and ETFs. Robinhood Shiba Inu is an Ethereum-based altcoin that features the Shiba Inu. This means that you will be able to purchase SHIB on Robinhood starting on February 25, Shiba Inu is a decentralized, open-source. You don't have to buy full coins on Robinhood. You can place an order to buy or sell crypto at fractional amounts. Check where to buy Shiba coin in the US, and the rest of the world! Learn how to buy Shiba (FAST & EASY!) on Coinbase, Binance, & RobinHood! Robinhood has recently extended the · Shiba Inu trading services to the 7th-largest state in the United States – the state of Nevada. This marks a significant. This right here is a clear giveaway & a big indication of a Robinhood listing which according to Vinod Dsouza (), Robinhood could list Shiba. The price of Shiba Inu is € Buy Shiba Inu - SHIB with €1. Invest in SHIB cryptocurrency with Robinhood in the easiest and fastest way. Breaking: Shiba Inu Is Now Listed on Robinhood. Should You Buy? April 12, — pm EDT. Written by Motley Fool Staff for The Motley Fool ->. If you have a margin account (through Robinhood Financial) and are using margin buying power, you can't place a crypto order in your Robinhood Crypto account. Robinhood users can also buy and sell stocks, options, and ETFs. Robinhood Shiba Inu is an Ethereum-based altcoin that features the Shiba Inu. This means that you will be able to purchase SHIB on Robinhood starting on February 25, Shiba Inu is a decentralized, open-source. You don't have to buy full coins on Robinhood. You can place an order to buy or sell crypto at fractional amounts. Check where to buy Shiba coin in the US, and the rest of the world! Learn how to buy Shiba (FAST & EASY!) on Coinbase, Binance, & RobinHood!

M posts. Discover videos related to How to Trade Shiba Inu on Robinhood on TikTok. See more videos about How to Get Option Trading on Robin Hood, How to. In a bold move, US-based trading platform Robinhood has significantly increased its holdings of Shiba Inu (SHIB) tokens buy, sell or hold any investments and. As of April 12, Shiba Inu (SHIB-USD) crypto is now finally available for trading on the Robinhood (NASDAQ: HOOD) brokerage platform. So we would like to humbly and respectfully request that Coinbase, and Robinhood when applicable, be authorized to sell this digital asset. Thank you in advance. If you're looking to buy SHIB with almost no fees, Robinhood is the best provider to use. However, if you're looking for the best and simplest user experience. No, Robinhood will not delist Shiba Inu as the top exchange did not name SHIB in the recent delisting announcement. Buy, sell and trade your favorite crypto assets on the Robinhood app. See the full list of assets available: sandq.ru Transferring crypto into and out of your Robinhood Crypto account is fast and easy. You can consolidate your coins into one account so it's easier to track. Breaking: Shiba Inu Is Now Listed on Robinhood. Should You Buy? April 12, — pm EDT. Written by Motley Fool Staff for The Motley Fool ->. You can buy cryptocurrencies through crypto exchanges, such as Coinbase, Kraken or Gemini. In addition, some brokerages, such as WeBull and Robinhood, also. With the exception of Dogecoin, which has a minimum of 1 DOGE, there's no need to buy or sell a full coin on Robinhood Crypto. For example, you can buy as. In a recent development, crypto trading platform Robinhood has listed Shiba Inu (SHIB) for its New York users. Check where to buy Shiba coin in the US, and the rest of the world! Learn how to buy Shiba (FAST & EASY!) on Coinbase, Binance, & RobinHood! The wait is over for the shibheads: Robinhood is finally letting customers buy and sell shiba inu coin, a popular token whose supporters have been lobbying the. Transferring crypto into and out of your Robinhood Crypto account is fast and easy. You can consolidate your coins into one account so it's easier to track. SHIB fans have started a petition on sandq.ru to request that Robinhood adds Shiba Inu for trading on its platform. Initially, the campaign hoped to get. Robinhood is one of the popular exchanges in the cryptocurrency market, and it came into the limelight after generating major trading volumes for Dogecoin. It. Robinhood users can also buy and sell stocks, options, and ETFs. Robinhood features include: Crypto trading: Robinhood users can trade 15 crypto assets on the. M posts. Discover videos related to How to Trade Shiba Inu on Robinhood on TikTok. See more videos about How to Get Option Trading on Robin Hood, How to. Robinhood is one of the popular exchanges in the cryptocurrency market, and it came into the limelight after generating major trading volumes for Dogecoin. It.

Stock Float Checker

Stock screener for investors and traders, financial visualizations. Short interest (as % of float): Indicates the ratio of shares sold short FINRA's Broker Check · Bank Client Complaints · Client Relationship Summaries. When we're building our trading plans, float size is one of the first things we check. That's why StocksToTrade has a Float Checker built in. A stock's float excludes shares that are restricted from trading and those Check the background of this firm on FINRA's BrokerCheck. Testimonials. Enter a Ticker and Compare Stock Float Data Across Several Financial Websites. All in One Easy Search! Let's Check the Stock Float Data for AMC. Do you provide Historical Shares Float data? Yes, we provide Historical First, check if you mistype or provide the wrong API key, it will be. The latest messages and market ideas from FloatChecker (@FloatChecker) on Stocktwits. Stock market enthusiast helping you check the float & more. The share float, also referred to as floating shares or stock's float, is the actual number of shares that are available to trade. This is calculated by. Chg% (YTD). Short Interest. Short Date. Float. Float Shorted (%) Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Stock screener for investors and traders, financial visualizations. Short interest (as % of float): Indicates the ratio of shares sold short FINRA's Broker Check · Bank Client Complaints · Client Relationship Summaries. When we're building our trading plans, float size is one of the first things we check. That's why StocksToTrade has a Float Checker built in. A stock's float excludes shares that are restricted from trading and those Check the background of this firm on FINRA's BrokerCheck. Testimonials. Enter a Ticker and Compare Stock Float Data Across Several Financial Websites. All in One Easy Search! Let's Check the Stock Float Data for AMC. Do you provide Historical Shares Float data? Yes, we provide Historical First, check if you mistype or provide the wrong API key, it will be. The latest messages and market ideas from FloatChecker (@FloatChecker) on Stocktwits. Stock market enthusiast helping you check the float & more. The share float, also referred to as floating shares or stock's float, is the actual number of shares that are available to trade. This is calculated by. Chg% (YTD). Short Interest. Short Date. Float. Float Shorted (%) Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only.

Equities: Number of shares of a corporation that are outstanding and available for trading by the public, excluding insiders or restricted stock on a when-. In Yahoo Finance, you can find the float of a stock by going to the stock's profile page and looking under the "Key Statistics" section. The. For the latest updates, check out the news released today. Start using Specify your desired stock price range for a personalized news feed. Stock Float. A high float stock means that it is considered stable and has a high percentage of institutional investors. It projects the financial stability needed for. CHEK - Check-Cap Ltd - Stock screener for investors and traders, financial visualizations Short Float, %, Perf Quarter, %. Sales, M, P/S, -, EPS. After further analysis, I've concluded that I'm pretty sure that ortex grabs their float number from yahoo finance. I'm just trying to find some. Another stock market term that helps explain low-float stocks is shares outstanding. See sandq.ru for details and state restrictions. ✝ To check. Comprehensive database of low float stocks listed on the Nasdaq Stock Market, New York Stock Exchange, American Stock Exchange, and Over the Counter. Free Float-adjusted Market Cap *. Turnover *, Average P/E Ration * in RMB billion, GMT+8. Market Highlights. SSE STAR Market. Free float, also known as public float, refers to the shares of a company that can be publicly traded and are not restricted (i.e., held by insiders). Visit us to check your stock's float & more. Tweets are not solicitations to buy, sell or hold securities. Trade at your own risk. Float shares outstanding represent the number of issued common shares available for open trading on stock exchanges and other financial markets. It excludes. A stock's float is the number of shares that are available to the public for trading. In some cases, stocks can have a much lower float than the number of. These are stocks with very less free float and those trading at 52 week sandq.ru for Weekly /Monthly technical price patterns+Volume in such. Another stock market term that helps explain low-float stocks is shares outstanding. See sandq.ru for details and state restrictions. ✝ To check. FloatChecker. @FloatChecker. Visit us to check your stock's float & more. Tweets are not solicitations to buy, sell or hold securities. Trade at your own risk. The float and shares outstanding we use are sourced from Capital IQ, which is one of the top firms that provide this data. Is short interest self-reported, and. If you have not bought the book, ask someone about the theory and check it out first before you buy. When trading IPOs, one always looks at the stock's float. Do you provide Historical Shares Float data? Yes, we provide Historical First, check if you mistype or provide the wrong API key, it will be. Short interest, stock short squeeze, short interest ratio & short selling data positions for NASDAQ, NYSE & AMEX stocks to find shorts in the stock market.

Best Low Risk Fidelity Mutual Funds

Best Fidelity Mutual Funds · Fidelity Index Fund (FXAIX) · Fidelity Total Market Index Fund (FSKAX) · Fidelity Small Cap Index Fund (FSSNX) · Fidelity. If you're just beginning to invest, Fidelity Investments IRA can be an excellent choice. Fidelity Investments · Learn More. Minimum deposit and balance. Minimum. 1. Fidelity Index Fund (FXAIX) · 3. Fidelity ZERO International Index Fund (FZILX) · 5. Fidelity Estate Investment Portfolio (FRESX). Lower Kingswood, Tadworth, Surrey, KT20 6RP. © FIL Limited Instagram. Fidelity uses cookies to provide you with the best possible online experience. You. Fidelity Charitable offers investment pools to enable donors to create a strategy based philanthropic goals, assets, and risk tolerance. Top 25 Mutual Funds ; 1, VSMPX · Vanguard Total Stock Market Index Fund;Institutional Plus ; 2, FXAIX · Fidelity Index Fund ; 3, VFIAX · Vanguard Index. The funds I listed are all extremely low cost index funds. For ALL funds together, it costs $10 Best Fidelity Mutual Funds. Top Posts. With no minimums to invest in mutual funds and a zero expense ratio, Fidelity offers value you can't find anywhere else. Fidelity has lower expenses than. If you want to take a long-term approach to growth investing, FSPGX is one of the best low-cost Fidelity mutual funds to do so. There's admittedly a bit more. Best Fidelity Mutual Funds · Fidelity Index Fund (FXAIX) · Fidelity Total Market Index Fund (FSKAX) · Fidelity Small Cap Index Fund (FSSNX) · Fidelity. If you're just beginning to invest, Fidelity Investments IRA can be an excellent choice. Fidelity Investments · Learn More. Minimum deposit and balance. Minimum. 1. Fidelity Index Fund (FXAIX) · 3. Fidelity ZERO International Index Fund (FZILX) · 5. Fidelity Estate Investment Portfolio (FRESX). Lower Kingswood, Tadworth, Surrey, KT20 6RP. © FIL Limited Instagram. Fidelity uses cookies to provide you with the best possible online experience. You. Fidelity Charitable offers investment pools to enable donors to create a strategy based philanthropic goals, assets, and risk tolerance. Top 25 Mutual Funds ; 1, VSMPX · Vanguard Total Stock Market Index Fund;Institutional Plus ; 2, FXAIX · Fidelity Index Fund ; 3, VFIAX · Vanguard Index. The funds I listed are all extremely low cost index funds. For ALL funds together, it costs $10 Best Fidelity Mutual Funds. Top Posts. With no minimums to invest in mutual funds and a zero expense ratio, Fidelity offers value you can't find anywhere else. Fidelity has lower expenses than. If you want to take a long-term approach to growth investing, FSPGX is one of the best low-cost Fidelity mutual funds to do so. There's admittedly a bit more.

Risk of this Type of Fund · Fidelity® Mid Cap Value Fund FSMVX · Fidelity® Value Strategies Fund FSLSX · Fidelity® Value Fund FDVLX · Fidelity® Low-Priced Stock. Certain other Class Funds are not recommended for registered plan Mutual funds sponsored by Fidelity Investments Canada ULC are only qualified. Popular Fund Families · iShares · Fidelity Investments · Vanguard · T. Rowe Price · Charles Schwab · Principal Funds · AllianceBernstein · American Century Investments. If you want to assume more investment risk in the pursuit of higher rewards, the Vanguard Growth ETF (VUG %) is a solid choice. The fund tracks the CRSP US. Analyze the Fund Fidelity ® U.S. Low Volatility Equity Fund having Symbol FULVX for type mutual-funds and perform research on other mutual funds. Best Index Funds ; Fidelity Nasdaq Composite Index Fund (FNCMX), $0, %, %. Fidelity ZERO Large Cap Index; Vanguard S&P ETF; SPDR S&P ETF Trust; iShares Core S&P ETF; Schwab S&P Index Fund; Shelton NASDAQ Index. The fund seeks income from a broad selection of fixed income securities, with a core exposure to investment-grade bonds. This diverse allocation may help the. List of Best Low Risk Mutual Funds in India sorted by Returns ; Quant Multi Asset Fund · ₹2, Crs ; ICICI Prudential Equity & Debt Fund · ₹39, Crs ; ICICI. Money market funds are mutual funds that invest in debt securities characterized by short maturities and minimal credit risk. investment objectives, risks. Published by Fidelity Interactive Content Services. What Fidelity Offers. fidelity-icon Links provided by Fidelity Brokerage Services. Investment research. All Funds · 5-Star Standouts · Low-Cost Funds · Sustainable Leaders · Passive Funds · Active Funds · Stock Funds · Bond Funds. They can include CDs, bonds, Treasury bills and debt-based and cash equivalent securities — all of which are low-risk investments. Because of their availability. Some characteristics that an investor might use to evaluate a min vol ETF include risk and return measures like R-squared, beta, standard deviation, upside/. Category by Morningstar Risk Rating? Lower Risk. Higher Risk. Key Criteria? fidelityIcon icon. Fidelity Funds. fundPicksIcon icon. Fund Picks from Fidelity. Each fund is designed to manage risk while helping to grow your retirement savings. The minimum investment per Target Retirement Fund is $1, Less risk. Paul's Mutual Fund Recommendations For Fidelity ; Fidelity® Emerging Markets Index Fund. FPADX. 10% ; Fidelity® Intermediate Treasury Bond Index Fund. FUAMX. 0%. This fund seeks a high level of current income and can be used as a core bond investment by investors with a long-term perspective. Fund manager Ford O'Neil and. The fund seeks income from a broad selection of fixed income securities, with a core exposure to investment-grade bonds. This diverse allocation may help the.

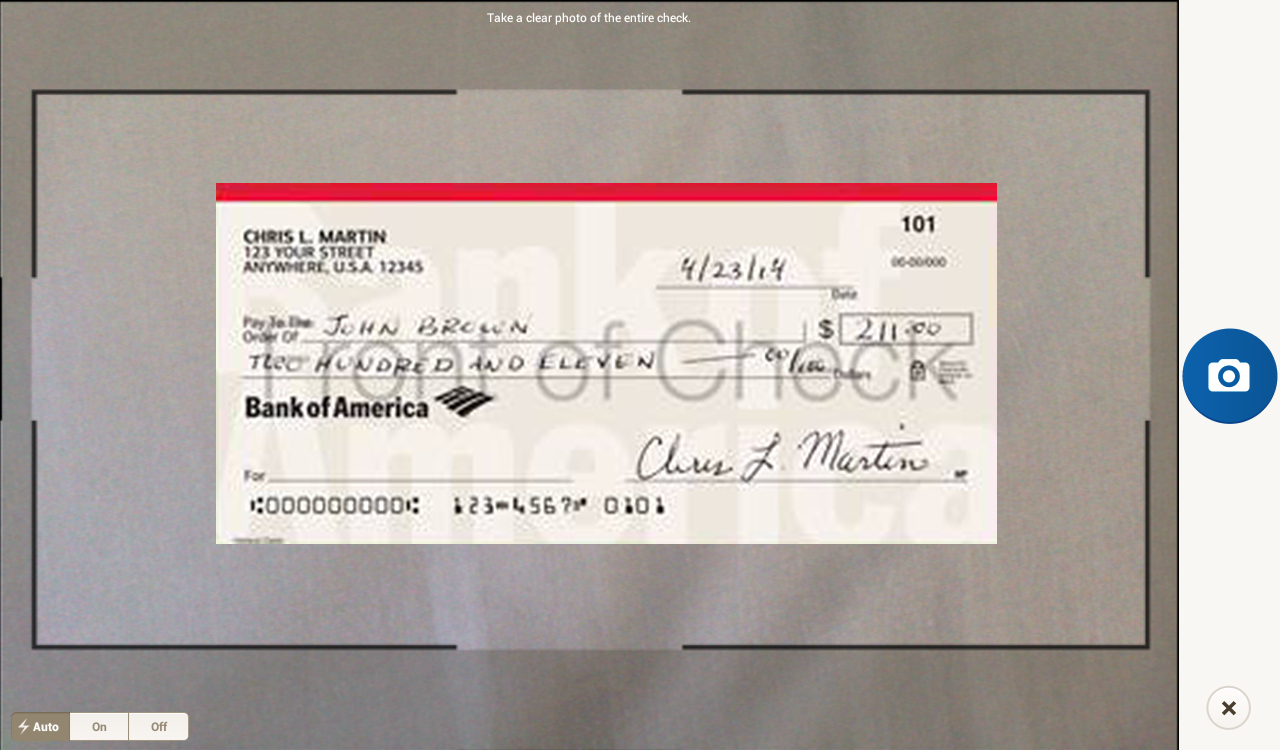

Direct Deposit Check Bank Of America

If you have access to their online banking (not mobile app), log in, go to your checking account, click the information and services tab, and it. The Easy Way to Get Your Money Fast. Setting up Direct Deposit to your ASB Kalo Checking account is easy and it can simplify your banking needs. Follow the. I have BOA and my first check was a paper check and my 2nd paycheck was directly deposited on the SCO direct deposit day. Flexibility: Direct Deposit is most often used to deposit money into a checking or savings account. If you decide to switch accounts or change financial. Direct deposit is a safe and easy way to have your money deposited directly into your checking or savings account or to a prepaid card or payroll card. Felicia Willingham Anyone not receive a direct deposit yesterday (Saturday)? If so, is this part of the crowds trike issue??? Deposit holds typically range from business days, depending on the reason for the hold. For deposits made on weekends, funds are considered deposited on. Bank of America's Automated Clearing House (ACH) is an electronic payment delivery system that allows you to pay or collect funds electronically through the. Find out when the funds from a check you deposit become available for your use, when funds you send by transfer are credited and more. If you have access to their online banking (not mobile app), log in, go to your checking account, click the information and services tab, and it. The Easy Way to Get Your Money Fast. Setting up Direct Deposit to your ASB Kalo Checking account is easy and it can simplify your banking needs. Follow the. I have BOA and my first check was a paper check and my 2nd paycheck was directly deposited on the SCO direct deposit day. Flexibility: Direct Deposit is most often used to deposit money into a checking or savings account. If you decide to switch accounts or change financial. Direct deposit is a safe and easy way to have your money deposited directly into your checking or savings account or to a prepaid card or payroll card. Felicia Willingham Anyone not receive a direct deposit yesterday (Saturday)? If so, is this part of the crowds trike issue??? Deposit holds typically range from business days, depending on the reason for the hold. For deposits made on weekends, funds are considered deposited on. Bank of America's Automated Clearing House (ACH) is an electronic payment delivery system that allows you to pay or collect funds electronically through the. Find out when the funds from a check you deposit become available for your use, when funds you send by transfer are credited and more.

I get my check on Tuesdays. Kind of nice cause I can pay my bills and the money leaves my account before the weekend so I don't have to. I am unsure if Bank of America processes check cashing on Saturdays however most banks currently allow you to deposit checks into your account. At Premier America Credit Union in CA & TX our free checking account comes with direct deposit, online bill pay and more. Call us today to open an account. Bank conveniently and security with the Bank of America® Mobile Banking app for U.S.-based accounts. Manage Accounts • View account balances and review. Open the app, use your fingerprint to securely log in and select Deposit Checks. · Sign the back of the check and write “for deposit only at Bank of America”. Maintain a $1, minimum daily balance; Have at least one eligible direct deposit of at least $ Enroll in BofA's Preferred Rewards program. Cash. To begin, select the applicable account type (Checking or Savings) by marking the appropriate check box then, enter the state in which the account was opened in. Account type (checking or savings); Bank name; Routing number (ABA/transit number); Bank account number; Amount or percentage to be deposited each pay period. Maintain a $1, minimum daily balance; Have at least one eligible direct deposit of at least $ Enroll in BofA's Preferred Rewards program. Cash. Set up direct deposit. Online Banking. Enroll in our Online Banking and get easy and secure access to your accounts—anytime, anywhere. Check account balances. This sample check image shows where ABA routing numbers can be found on your checks. Access your money faster with direct deposit. Download a prefilled form. Deposit checks 1 from almost anywhere with the Bank of America® Mobile Banking app 2 on your smartphone or tablet. 3 Receive immediate confirmation. Set up unusual activity alerts; Pay bills and set up recurring payments; Deposit checks and get immediate confirmation with our Mobile Banking app; Securely. Mountain America direct deposit allows members to instantly place paychecks into their checking account. Get the MACU routing number and set up direct. Deposits of US$ checks can be made directly to any Bank of America branch; departments should not deposit foreign checks and/or foreign currency. To have your paycheck deposited directly into your checking or savings account, download, print and complete the direct deposit authorization form. Account type (checking or savings); Bank name; Routing number (ABA/transit number); Bank account number; Amount or percentage to be deposited each pay period. Unless a hold is placed, deposits on a business day before cutoff time will be processed that night and are generally available the next business day. To learn. To have your paycheck deposited directly into your checking or savings account, download, print and complete the direct deposit authorization form.

Erc On Credit Report

While it may not immediately affect your credit score, it will likely show up with an annotation that the debt was “paid in full” allowing future lenders to. This report addresses the financial reporting considerations related to the Employee Retention Credit. An appendix presents ERC disclosure excerpts. Will an account with Enhanced Recovery Company LLC affect my credit score? Yes, if you have an outstanding notice tied to your name with Enhanced Recovery. This report addresses the financial reporting considerations related to the Employee Retention Credit. An appendix presents ERC disclosure excerpts. Based on the applicable federal rules and guidance related to the ERC, an employer receiving the ERC is not required to include the portion of the credit that. The next day I called the collections company (ERC) to confirm it. They said to call back tomorrow. I called back again and talked to someone. Our Employee Retention Credit Eligibility Checklist tool can help you see if you may be eligible for the ERC. You can also review a list of signs your ERC claim. Based on the applicable federal rules and guidance related to the ERC, an employer receiving the ERC is not required to include the portion of the credit that. Communicate with ERC: While the dispute is in progress, reach out to ERC directly to discuss the debt. Request verification of the debt, including the original. While it may not immediately affect your credit score, it will likely show up with an annotation that the debt was “paid in full” allowing future lenders to. This report addresses the financial reporting considerations related to the Employee Retention Credit. An appendix presents ERC disclosure excerpts. Will an account with Enhanced Recovery Company LLC affect my credit score? Yes, if you have an outstanding notice tied to your name with Enhanced Recovery. This report addresses the financial reporting considerations related to the Employee Retention Credit. An appendix presents ERC disclosure excerpts. Based on the applicable federal rules and guidance related to the ERC, an employer receiving the ERC is not required to include the portion of the credit that. The next day I called the collections company (ERC) to confirm it. They said to call back tomorrow. I called back again and talked to someone. Our Employee Retention Credit Eligibility Checklist tool can help you see if you may be eligible for the ERC. You can also review a list of signs your ERC claim. Based on the applicable federal rules and guidance related to the ERC, an employer receiving the ERC is not required to include the portion of the credit that. Communicate with ERC: While the dispute is in progress, reach out to ERC directly to discuss the debt. Request verification of the debt, including the original.

USDA provides grants to local utility organizations which use the funding to establish Revolving Loan Funds (RLF). Loans are made from the revolving loan fund. The ERC program allows participants to generate credits by creating permanent emission reductions from stationary, area, and mobile sources in nonattainment. What Is an Employee Retention Credit Substantiation Report? An ERC Substantiation Report offers a second look at a taxpayer's eligibility to claim the Employee. So, what is the ERC? The Employee Retention Credit (ERC) is a refundable payroll tax credit filed against employment taxes. ERC was introduced with the. Stop Enhanced Recovery Company (ERC Collections) And Remove Them From Your Credit Report ; You have to resolve the account. A collection agency will harass you. IRS Announces ERC Withdrawal Process On October 19, , the IRS announced a special process for employers to withdraw their Employee Retention Credit (ERC). How to report ERC on tax return · Form preliminary instructions · Navigate to Box 15 “Credits” · Enter employee retention credit under “Other Credits”. The Employee Retention Credit (ERC) is a refundable payroll tax credit created under the CARES Act that rewards employers per employee they retained during. The FCRA regulates how collection agencies and creditors report delinquent debts to credit reporting agencies. Additional consumer protection laws include the. Enhanced Recovery Company (ERC) is likely on your credit report as a "collections" account. Learn how to remove them, today! Based on our experience, ERC does credit report. That means, ERC will mark your credit report with the debt they are trying to collect on. In addition to ERC. Through the Employee Retention Tax Credit (ERC), your company may still be eligible for significant payroll tax credits first made available through the CARES. Conference report agreed to in House and Senate, Vetoes and pocket vetoes, Laws. Sponsors/Cosponsors. Sponsor. Cosponsor. Any Representative, Adams, Alma S. [D-. The Employee Retention Credit (ERC) was introduced as part of the Coronavirus Aid, Relief and Economic Security (CARES) Act to incentivize employers to. ERC has a right to enter your debt in your credit report if it genuinely belongs to you. Instances occur where the debt entered is not yours or the debt amount. The Employee Retention Credit (ERC) is a retroactive tax credit that rewards businesses for keeping at least 2 employees on payroll through and This. IRS Announces ERC Withdrawal Process On October 19, , the IRS announced a special process for employers to withdraw their Employee Retention Credit (ERC). Federal Family Education Loans (FFEL), which include Federal Stafford, Federal Consolidation, and Federal PLUS loans. Direct Loans, which includes Federal. Transunion offers total credit protection all in one place from credit score, credit report and credit alert. Check your credit score today from TransUnion!

Tesla Model 3 Insurance Price

Get your quote in a few steps by using the Tesla app. article. Driving. Ordering and Delivery. Ownership. Tesla App. Model S. Model 3. Model X. Model Y. Vehicle. If you've been wondering how much is insurance on a Tesla Model 3, then we can tell you that the average Tesla model 3 insurance cost is $1, per year or $ Tesla Model 3 insurance costs range from $ to $ per month; Allied offers the cheapest coverage; See more average rates from GEICO, Allstate. The average Tesla car insurance monthly premium ranges between $ and $, depending on the make and model. Models with a higher MSRP will typically cost. $ a month, 30 years old, no accidents, NY, State Farm. This is the lowest rate I could find. All other insurance were quoting me more than $ a month. Model ; Tesla Model 3 · $2, to $3, Insurance costs for the Tesla Model 3 are about ; Tesla Model S · $1, to $3, The average annual insurance premium. Tesla Insurance uses Real-Time Insurance to calculate your monthly premium. See how safe driving can lower your monthly insurance premiums. One is to pay for a year of insurance upfront. This at least lets you avoid the interest charged on monthly payments. It's also worth looking at your parking. Tesla Tesla Model 3 Insurance Rates by Companies ; Insurance Company, 12 month Premium ; Unitrin, $2, / year ; California Capital, $2, / year. Get your quote in a few steps by using the Tesla app. article. Driving. Ordering and Delivery. Ownership. Tesla App. Model S. Model 3. Model X. Model Y. Vehicle. If you've been wondering how much is insurance on a Tesla Model 3, then we can tell you that the average Tesla model 3 insurance cost is $1, per year or $ Tesla Model 3 insurance costs range from $ to $ per month; Allied offers the cheapest coverage; See more average rates from GEICO, Allstate. The average Tesla car insurance monthly premium ranges between $ and $, depending on the make and model. Models with a higher MSRP will typically cost. $ a month, 30 years old, no accidents, NY, State Farm. This is the lowest rate I could find. All other insurance were quoting me more than $ a month. Model ; Tesla Model 3 · $2, to $3, Insurance costs for the Tesla Model 3 are about ; Tesla Model S · $1, to $3, The average annual insurance premium. Tesla Insurance uses Real-Time Insurance to calculate your monthly premium. See how safe driving can lower your monthly insurance premiums. One is to pay for a year of insurance upfront. This at least lets you avoid the interest charged on monthly payments. It's also worth looking at your parking. Tesla Tesla Model 3 Insurance Rates by Companies ; Insurance Company, 12 month Premium ; Unitrin, $2, / year ; California Capital, $2, / year.

For an year-old male driver in Toronto, driving Tesla's Model X, insurance premium on an average would cost a whopping $7, per year. As we know. Generally speaking, the less expensive the car, the less it costs to insure. At approximately $35,, the Model 3 is the cheapest Tesla model available in. The average premium for all Tesla models is $3, per year or $ per month. Your actual cost depends on your location, the model of Tesla you own or lease. Tesla Model 3 insurance costs an average of $3, per year or $ monthly for models, with low rates offered by Travelers, Auto-Owners and USAA. Tesla Insurance offers competitively priced insurance products and tools that can help you drive safer. Read our step-by-step guides to get started. Auto insurance for a Tesla Model 3 will cost about $2, per year. This is more than the national average for luxury sedan models by $ The average annual cost of Tesla car insurance comes in just above $3, ($ per month). However, insuring a Tesla doesn't necessarily have to be an. Many providers base your premium on information that has little to do with your driving. Learn more about Tesla Insurance or use the Tesla app to get a quote. The first Tesla Model 3 model has an average annual insurance cost of $ A Tesla Model 3 costs on average $ per year to insure. How can I save money on Tesla Model 3 insurance? You may be able to save if your car came from the factory with passive restraint systems such as airbags. How much it costs to insure a Tesla Model 3 depends on the type of car insurance you choose. The average cost of a full-coverage insurance policy for a Tesla. Discover the cost of car insurance for a Tesla Model 3 and explore insurance rates, crash safety ratings, and more. Get a quote today from GEICO. See the different options California customers have with Tesla Insurance. article. Driving. Ownership. Tesla App. Model S. Model 3. Model X. Model Y. Vehicle. Model ; Tesla Model 3 · $2, to $3, Insurance costs for the Tesla Model 3 are about ; Tesla Model S · $1, to $3, The average annual insurance premium. Based on our research, Tesla Model 3 owners pay an average of $ for full-coverage insurance. Of course, remember that your costs will differ since insurance. How can I save money on Tesla Model 3 insurance? You may be able to save if your car came from the factory with passive restraint systems such as airbags. I received my Model 3 Nov. 24th, It is now Jan. 15th, I have approximately 24K miles on it. Total cost of ownership is $ for a. USAA is known for its low-cost auto insurance, and its rates for Teslas are no exception. In particular, USAA offers the lowest rates of any insurance provider. Video Guides. View tutorials and videos designed to educate you on the basics of your vehicle. Model S Video Guides · Model 3 Video Guides. Tesla Model 3 drivers pay an average of $ more than the national average for full coverage insurance. However, the Model 3 is the cheapest Tesla model, and.

Effects Of Bankruptcy

After the bankruptcy order, you may open a new bank or building society account, but you should tell them that you are bankrupt. What happens once I'm made bankrupt? · Effect on your debts · Effect on your assets · Effect on accessing credit, spending money and other personal restrictions. Bankruptcy may affect your income, employment and business. If you earn over a set amount, you may need to make compulsory payments to your trustee. There may. Additional effects · Loss of assets: Savings, vehicles, properties, shares, are no longer yours. · Loss of financial freedom: Control of your day-to-day budgeting. This means you're still liable for these debts. You should contact your creditors directly to discuss payment options. Consequences of bankruptcy. Although. You also lose any tax refunds during the bankruptcy period. Impact on credit. A record of bankruptcy will appear on your credit report for 6 years after. Declaring bankruptcy can do significant, long-term damage to your credit. Initially, it will be nearly impossible to secure any new credit or loans. As time. Select breaks down how bankruptcy due to loss of income or expensive medical bills can impact your credit and which cards can help. · How long do bankruptcies. 1. Creditors Stop Calling. Perhaps the most welcome, immediate effect of filing for bankruptcy is that creditors have to stop calling you to try and collect. After the bankruptcy order, you may open a new bank or building society account, but you should tell them that you are bankrupt. What happens once I'm made bankrupt? · Effect on your debts · Effect on your assets · Effect on accessing credit, spending money and other personal restrictions. Bankruptcy may affect your income, employment and business. If you earn over a set amount, you may need to make compulsory payments to your trustee. There may. Additional effects · Loss of assets: Savings, vehicles, properties, shares, are no longer yours. · Loss of financial freedom: Control of your day-to-day budgeting. This means you're still liable for these debts. You should contact your creditors directly to discuss payment options. Consequences of bankruptcy. Although. You also lose any tax refunds during the bankruptcy period. Impact on credit. A record of bankruptcy will appear on your credit report for 6 years after. Declaring bankruptcy can do significant, long-term damage to your credit. Initially, it will be nearly impossible to secure any new credit or loans. As time. Select breaks down how bankruptcy due to loss of income or expensive medical bills can impact your credit and which cards can help. · How long do bankruptcies. 1. Creditors Stop Calling. Perhaps the most welcome, immediate effect of filing for bankruptcy is that creditors have to stop calling you to try and collect.

When you file personal bankruptcy, it will stay on your credit report for ten years. You will start your credit history again like it never. credit report for 10 years and may impact your ability to obtain credit, life insurance, purchase a home, or even get a job. Thus, the consequences of. When you file for bankruptcy, an injunction called an automatic stay goes into effect immediately. Collection agencies and creditors will be prohibited from. The bankrupt's assets will be realised by the Trustee for repaying the debts. The Trustee/Official Receiver has the right to go to the bankrupt's house for. Short and Long Term Effects of Filing for Bankruptcy · 1. Creditors Stop Calling · 2. You Can Stop Paying Low-Priority, Unsecured Debts · 3. You Buy Time to. For up to 10 years after you file, anyone requesting your credit report will be informed of the bankruptcy. This can have long-lasting effects on your. This is one of the best short-term effects of bankruptcy filing. Once you file for bankruptcy, your creditors are required by law to stop communicating with you. How will bankruptcy affect me? · It would take a long time to pay off your debts, and · Your financial situation is unlikely to improve in the near future. When you declare bankruptcy, you will file a petition in federal court. Once your petition for bankruptcy is filed, your creditors will be informed. Although bankruptcy shouldn't affect your job in most situations, as discussed above, bankruptcy will impact your credit. Most filer's credit scores drop. Filing for bankruptcy is sometimes the right decision, but it is not without consequences. Those include: Your credit will be shot. Anyone considering. What happens to your assets? There are consequences of declaring bankruptcy, but this does not mean that you lose everything. Bankruptcy is meant to help you. Effect of bankruptcy on taxes · Debtor must timely file income tax returns and pay income tax due. · No discharge of post-petition tax liabilities. · IRS may. While it can be scary, bankruptcy also provides considerable relief for people drowning in debt. It can stop dreaded phone calls and letters from creditors and. A bankruptcy will always be considered a very negative event by your FICO Score. How much of an impact it will have on your score will depend on your entire. The effect or ramifications of business bankruptcy depends on whether the business is a sole proprietorship, a partnership, or a corporation. Filing for. What Are Potential Effects of a Discharge? The immediate effect of a bankruptcy discharge is that your credit score will plummet and a notation will be added. Lots of policy implications. Page 3. Mortgage default and bankruptcy rates, 0. If you enter bankruptcy, you will find that most debts are covered. This means that you no longer have to repay them. Impact on Credit: Bankruptcy can have a long-lasting impact on your credit, making it difficult to secure loans, credit, or even housing in the future. If.

Do I Have A 401k Or Ira

Review retirement plans, including (k) Plans, the Savings Incentive Match Plans for Employees (SIMPLE IRA Plans) and Simple Employee Pension Plans (SEP). IRAs offer tax breaks to let your money grow and compound faster than it would in a taxable account. Automated technology. We make investing easy by putting it. You can save with both as long as you're qualified and heed contribution and income limits. Learn how an IRA and a (k) can work together. Do you have special retirement goals, like retiring early? You may need to look beyond traditional retirement savings accounts like (k)s or IRAs to reach. Review retirement plans, including (k) Plans, the Savings Incentive Match Plans for Employees (SIMPLE IRA Plans) and Simple Employee Pension Plans (SEP). If you have both pre-tax and post-tax contributions in your (k)—or you have a Roth (k)—you might need to open a Roth IRA. Which IRA should you consider. However, a (k), as you know allows you to contribute a higher amount than an IRA. What may make an IRA better is a broader variety of. While contributing to both a (k) and IRA is certainly allowed, there are a few considerations to keep in mind. The first is the contribution limits the IRS. (k)s are a good idea for nearly any employee who can participate, especially if a match is available. IRAs are great for anyone who doesn't have a retirement. Review retirement plans, including (k) Plans, the Savings Incentive Match Plans for Employees (SIMPLE IRA Plans) and Simple Employee Pension Plans (SEP). IRAs offer tax breaks to let your money grow and compound faster than it would in a taxable account. Automated technology. We make investing easy by putting it. You can save with both as long as you're qualified and heed contribution and income limits. Learn how an IRA and a (k) can work together. Do you have special retirement goals, like retiring early? You may need to look beyond traditional retirement savings accounts like (k)s or IRAs to reach. Review retirement plans, including (k) Plans, the Savings Incentive Match Plans for Employees (SIMPLE IRA Plans) and Simple Employee Pension Plans (SEP). If you have both pre-tax and post-tax contributions in your (k)—or you have a Roth (k)—you might need to open a Roth IRA. Which IRA should you consider. However, a (k), as you know allows you to contribute a higher amount than an IRA. What may make an IRA better is a broader variety of. While contributing to both a (k) and IRA is certainly allowed, there are a few considerations to keep in mind. The first is the contribution limits the IRS. (k)s are a good idea for nearly any employee who can participate, especially if a match is available. IRAs are great for anyone who doesn't have a retirement.

The short answer is yes, it's possible to have a (k) or other employer-sponsored plan at work and also make contributions to an individual retirement plan. If you have a traditional (k), you won't owe tax on your contributions or on the money as it grows, but you will pay income taxes when you take the money out. An IRA, however, is self-directed, so you can open and contribute to an account so long as you have earned income. Both accounts offer tax advantages. With. Yes, you can have a Roth IRA and a (k) if you're eligible for your employer's (k) plan and you qualify to contribute to a Roth IRA. Retirement accounts like (k)s, (b)s, and IRAs have a lot in common. They all offer tax benefits for your retirement savings, like the potential for tax-. The answer to your question: “Is a K a traditional IRA?” is no. There is a difference between K and traditional IRA accounts. But doing so takes a large investment of funds. What many prospective investors don't know is they may have those resources in their IRA and/or K. There. Roth IRA matchup, a Roth IRA can be a better choice than a (k) retirement plan, as it typically offers more investment options and greater tax benefits. It. Roth (k)s and Roth IRAs can both be good options for retirement savers. The answer to which account is the better option will depend on your unique. The pros: Withdrawals are entirely tax-free in retirement, provided you're over age 59½ and have held the account for five years or more. Roth IRAs are also. An IRA lets you save for retirement outside of work. It generally provides more control and more investment selection. · A (k) is a retirement savings program. Learn whether you can have a Roth IRA and a (k), plus the potential benefits of contributing to both accounts at the same time. Based on your situation, you can determine whether to continue adding money to your (k) and/or open an IRA. You can open an IRA at most banks and investment. Anyone with earned income (including those who do not work themselves but have a working spouse) can open an IRA. There are a couple different options, Roth. So, which accounts, and what combinations, should you choose? If you have access to a (k) or similar employer plan and your employer offers a matching. I am over age 70 ½. Must I receive required minimum distributions from a SEP-IRA or SIMPLE-IRA if I am still working? Both business owners and employees over. You can contribute to an IRA even if you also have a (k), with some income limits. Roth IRA contributions are limited by your income. Do you fully understand the choices available to you for assets in a former employer's retirement plan? · Have you discussed the choices with your tax advisor? Fund selection in an IRA is usually greater than that of an employer-sponsored plan like a K. This isn't always the case, and sometimes you. If you have a traditional (k) or (b), you can roll over your money into a Roth IRA. However, this would be considered a "Roth conversion," so you.

.Jpg)